- 3 views

Liquidity as the New Driver of Market Dynamics

Banking system liquidity has emerged as the cornerstone of monetary transmission and a key driver of yield behaviour in recent years. While policy rates define the central bank’s stance, their actual influence on bond markets hinges on the availability of durable liquidity within the financial system. In an environment where liquidity conditions fluctuate, the effectiveness of rate changes can be muted, making liquidity management as critical as rate-setting in shaping market outcomes.

RBI’s Liquidity Actions in 2025

This year, the RBI has adopted a more proactive and granular approach to systemic liquidity management. Key measures include:

-

OMO Purchases:In CY2025, RBI conducted OMO (Open Market Operation) purchases totalling ₹5.49 lakh crore, significantly supporting system liquidity.

-

CRR Reduction: A cumulative 100 bps CRR (Cash Reserve Ratio) cut across four tranches (September–November) infused nearly ₹2.5 lakh crore into the banking system.

-

Fine-tuning Operations: Frequent short-term operations to smooth short-term liquidity volatility.

-

FX Buy/Sell Swaps: RBI executed $25 billion in FX swaps, further adding liquidity, while managing currency pressures.

Together, these actions reflect a shift toward active, data-driven liquidity calibration rather than reliance on a single instrument.

Liquidity Outlook and Need for Additional OMOs

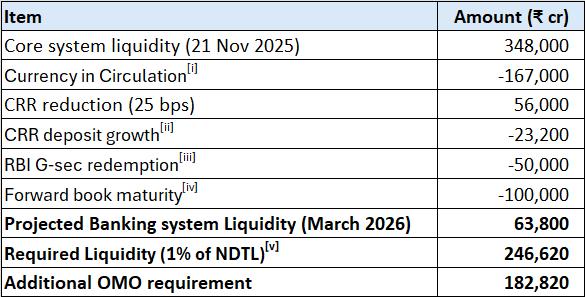

As per our assessment the banking system liquidity is projected to decline from ₹3.48 lakh crore in November 2025 to just ₹63,800 crore by the end of March 2026. As per the RBI’s April policy guidance, the central bank aims to maintain surplus liquidity at 1% of NDTL, which translates to nearly ₹2.46 lakh crore.

Current projections show a shortfall of around ₹1.83 lakh crore, indicating a clear requirement for further OMO purchases.

OMO Purchases: Actions So Far and What Lies Ahead

RBI has already conducted OMO purchases of ₹2.62 lakh crore this financial year. Yet, the projections indicate a sharp contraction in core system liquidity—from comfortable surplus levels to near-neutral conditions—raising important questions about RBI’s strategy to maintain its stated comfort zone of 1% of NDTL in surplus liquidity.

This evolving backdrop reinforces the significance of liquidity management tools, particularly OMOs as a central stabilising tool, with meaningful implications in shaping yield dynamics and ensuring overall financial stability.

Historical Context: OMO as % of Net Borrowing

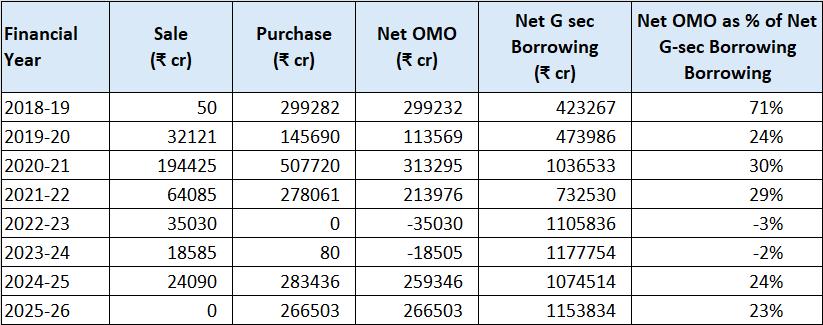

A look at past OMO activity shows RBI’s willingness to intervene decisively when liquidity tightens. In several years, OMO purchases accounted for over 20–25% of net G-sec borrowing.

The data shows that the RBI has consistently stepped in whenever the system liquidity required support, with OMO purchases accounting for more than 25% of net G-sec borrowing in certain years. In the current environment, where the RBI has indicated its readiness to maintain liquidity around 1% of NDTL, we believe that the RBI may resort to further OMO purchases even in this financial year to ensure smooth liquidity and effective yield management.

Conclusion: Liquidity as the Key Market Driver

Liquidity—not just policy rates—has emerged as the dominant force shaping India’s bond market this fiscal year. Looking ahead, the banking system is poised to remain in a healthy liquidity surplus, aided by the RBI’s calibrated and forward-looking liquidity operations.

With durable liquidity still above pre-pandemic levels and transient swings managed through fine-tuning tools, the central bank is likely to continue favouring OMO purchases—particularly in the 5-to-10-year segment—to stabilise yields while ensuring adequate liquidity. This should ensure smoother credit transmission. Consequently, the yield curve is expected to retain its steepness in the near term, reflecting an environment of comfortable systemic liquidity and balanced policy signalling.

Sources: RBI, Bloomberg, UTI Research

[i] Currency in Circulation (CIC): Assumed from December to March as the average of CIC for the same period over the last two years.

[ii] Additional CRR Requirement: Based on an assumed 10% growth in NDTL.

[iii] RBI Holdings of G-Secs: Assumed as per current estimates.

[iv] Forward Position: As per latest RBI data, the short forward position for December and January totals $36 billion. Assumed that this includes non-deliverable contracts and a portion of the position will be rolled over by RBI.

[v] 1% of Dec NDTL

The views expressed are the author’s own views and not necessarily those of UTI Asset Management Company Limited. The views are not investment advice and investors should obtain their own independent advice before taking a decision to invest in any asset class or instrument.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Amit Sharma is Vice President & Fund Manager – Debt. He joined UTI in 2008. He has worked in Department of Fund Accounts. He has been associated with the Dept. of Fund Management for the past 4 years.