Fixed income funds have delivered strong returns over the past two years as inflation declined sharply from the post-pandemic surge of 2022–23. This disinflationary impulse enabled central banks to pivot decisively towards monetary easing, with 211 and 189 policy rate cuts recorded by global central banks in 2024 and 2025, respectively, well above the post-GFC peak of 181 cuts in 2009 (Source: Bloomberg).

As we head into 2026, the global macro narrative is characterised by a rare triumvirate of easy fiscal policy, accommodative monetary conditions, and increasing government deregulation, particularly in the United States. Crucially, these forces operate pro-cyclically outside of recession. Hence, the overall environment remains supportive of growth, risk assets and corporate investment despite the ongoing supply-side challenges from geopolitical frictions and trade disruptions.

Global Macro Backdrop

Outlook on growth - Investment cycle to sustain global growth

Global growth appears set to remain robust into 2026, supported by strong investment demand from both private and public sectors.

The AI investment cycle has moved from a technological breakthrough into hard infrastructure spending in data centres, power generation, grid upgrades and semiconductor fabrication led by the US and China. According to industry estimates, data centres alone could require close to $7trn in global capital expenditure by 2030, pointing to a multi-year investment super-cycle with meaningful productivity spillovers over the medium to long term (Source: Mckinsey)

Europe’s fiscal stance has become more expansionary following the war in Ukraine, with aggressive spending plans on defence, green and digital transitions. As per European Central Bank (ECB) research estimates, meeting these objectives could require additional public spending of around €510bn annually through to 2035 or roughly 3.3% of EU GDP per year (Source: ECB).

Outlook on inflation – Stable with limited downside

Inflation has moderated meaningfully across most economies and is expected to ease further with still-elevated service inflation gradually softening with marginal cooling in the labour market. That said, expectations of a durable return to central-bank targets across advanced economies may prove optimistic.

In our view, inflation remains a two-way risk over the medium term. The disinflationary impulse from easing services prices is likely to be partially offset by persistent fiscal expansion, sustained investment in technologies, elevated defence spending and the reshoring of strategic supply chains.

These forces point to a structurally firmer inflation backdrop than that implied by near-term headline CPI trajectories. In this environment, long-term inflation expectations and growth dynamics matter more than near-term CPI prints. As markets internalise that governments are less willing as well as less able to consolidate their fiscal position, bond markets may demand higher-term premia. That said, a tail risk remains in the form of a sharper-than-expected slowdown in the US labour market, which could cause deeper disinflation and a more aggressive easing of monetary policy.

The yield curve: Steepness is “not a bug”

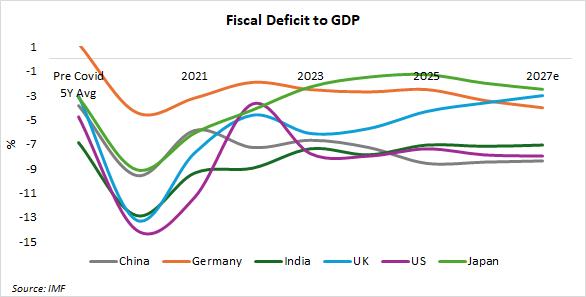

Once governments stepped onto the fiscal treadmill, the fiscal support implemented post-COVID has been difficult to fully withdraw as large structural deficits have become entrenched across the world. As seen in Chart 1 below, barring Japan, most of the major economies are yet to return to their pre-COVID fiscal deficit levels despite strong growth in the last two years. Nowhere is this clearer than in the US, where an 8% deficit compared to its pre-COVID levels of 4.8% (5-year average) is present alongside an economy at full employment.

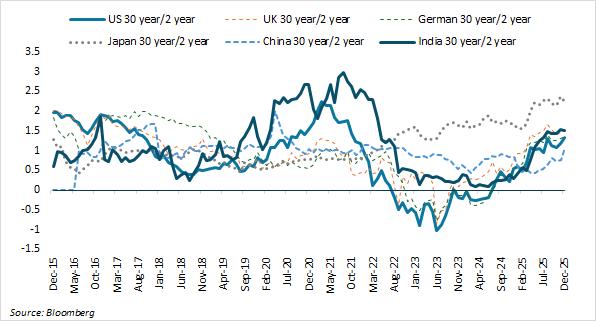

As fiscal dominance becomes more visible, curves (chart below) are likely to remain structurally steep. The steeper curves largely reflect:

-

Rising term premia as central bank balance sheets are stabilising after large rounds of QE during COVID, while sovereign issuance continues to expand.

-

A resilient growth outlook.

-

Higher compensation expectations due to an uncertain inflation outlook on account of trade and geopolitical frictions.

India: Fiscal evolution and yield-curve implications

Unlike many advanced economies, India’s macro fundamentals have improved materially, supported by structural reforms and a credible monetary policy framework. This is also reflected in the narrowing yield spreads between Indian Government bonds and advanced-economy sovereign bonds.

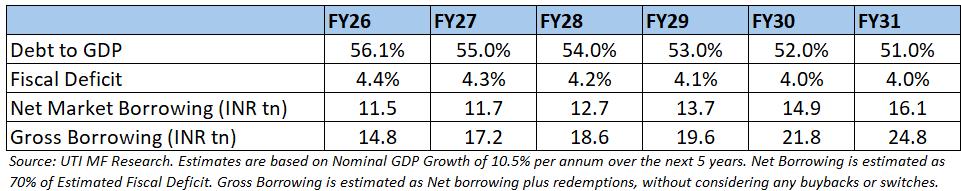

India is one of the few major economies that has demonstrated meaningful fiscal consolidation from 9.2% of GDP in FY21 to 4.4% in FY26.

To ensure longer-term debt sustainability, the government has moved from fiscal deficit targeting to Debt/GDP targeting. This shift aims to reduce the debt-to-GDP ratio from 56.1% in FY26 to around 50% (±1%) by FY31. This framework should allow the Government to retain fiscal flexibility and provide the ability to react to future growth shocks.

This is precisely the environment in which the short to medium end of the yield curve could offer relative value.

Even if nominal GDP growth stays in double digits, fiscal consolidation is likely to be modest, with consolidation efforts skewed toward incremental gains. As reflected in the table below, gross borrowing is projected to rise materially over the coming years.

Additional duration supply through State borrowing could also weigh on the yield curve.

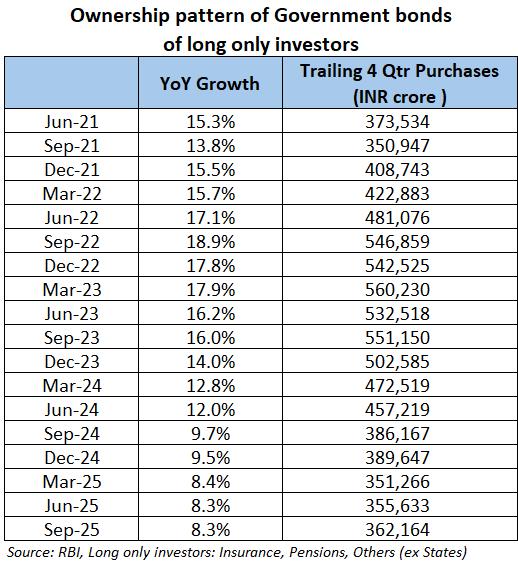

Even in a scenario of robust nominal GDP growth, government borrowing is likely to rise, while incremental flows from traditional long-only investors such as provident funds, pension funds and insurers are slowing (see table below) as portfolios diversify toward other asset classes. With banks increasingly prioritising credit growth, their incremental demand for sovereign securities is also expected to remain moderate.

However, an important nuance applies in India. Government spending has increasingly been directed toward capital expenditure, supporting long-term growth and improving debt sustainability. A stable inflationary environment, manageable debt dynamics, and predictable fiscal policy should allow the yield curve to remain somewhat steeper than in recent years, but orderly and well-contained.

Portfolio implications and investor takeaway

We expect CPI to pick up to around 4% in FY27. There could be some transitory spikes due to a lower base this year, but we expect RBI to look through them and maintain its growth-supportive stance, keeping liquidity accommodative and policy rates lower for longer. While adverse external developments could warrant incremental policy easing, this is not our base-case scenario.

Given India’s inflation stability, credible fiscal path and supportive policy and liquidity stance, the risk-reward ratio continues to be appealing in the one–three-year segment. It continues to offer superior risk-adjusted accrual, lower volatility, favourable roll-down opportunities and reduced sensitivity to global yield-curve steepening. There may be tactical opportunities at the long end, particularly during periods of risk aversion, global growth scares or excessive supply concerns, but these should be approached opportunistically, not structurally.

Given the evolving macro and policy backdrop, we are maintaining:

-

Moderate duration bias, anchored in the one-three-year segment, where carry and roll-down remain attractive. This positioning continues to benefit from a relatively steep curve and short-end rates that are well supported by surplus system liquidity.

-

Selective credit exposure focused on high-quality corporate issuers and well-managed NBFCs, supported by benign funding conditions, stable balance sheets and ample system-level liquidity.

-

Cautious approach to long-duration exposure, where incremental return potential appears limited in the absence of a material growth or inflation shock. That said, we remain open to opportunistic participation at the long end when valuations become compelling.

Overall, the current environment remains supportive for accrual- and carry-oriented strategies, with curve steepness and stable credit spreads offering selective opportunities.

Suggested asset allocation framework by time horizon

-

3–12 months: Investors may consider Money Market Funds or Low Duration Funds, which are suitable for managing short-term surplus while maintaining liquidity.

-

12-24 months: Investors may consider Short Duration Funds and Corporate Bond Funds, which are well-positioned to benefit from a benign macro backdrop and a liquidity-rich environment.

-

More than 24 months: Investors may consider Income plus Arbitrage strategies for tax-efficient return generation.

The views expressed are author’s own views and not necessarily those of UTI Asset Management Company Limited.

All illustrations/ examples are purely meant for ease of understanding of the concepts and aid in planning by the investor. All illustrations/ examples that depict future values or other estimated numbers are based on reasonable assumptions and in no way give any guarantee or assurance or indication of the future performance. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this article, will be suitable for your portfolio. Please note that past performance may or may not be sustained in future and is not a guarantee of any future returns. The reader is urged to consult his or her financial advisor before making any investment decisions.

UTI Asset Management Company Limited (UTI AMC) or UTI Mutual Funds (UTI MF) along with its affiliates assumes no obligation to update or otherwise revise these estimates.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Anurag Mittal is the Head - Fixed Income at UTI Asset Management Company Ltd. He is a Chartered Accountant affiliated with Institute of Chartered Accountant of India and holds a degree in Master of Science from University of London. He previously held the office of Senior Fund Manager at IDFC Asset Management Company Private Limited and managed key IDFC debt mutual fund schemes. Prior to this, he was associated with HDFC Asset Management Company Limited as Senior Manager - Investments and Axis Asset Management Company Limited as Fund Manager - Investments, responsible for Fund Management, Dealing and Research.