- 3 views

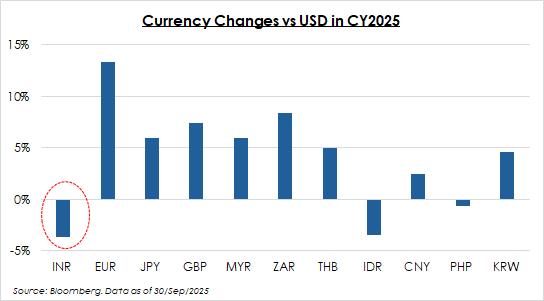

The Indian Rupee (INR) has been on a weaker trajectory in 2025, depreciating by 3.7% against the US Dollar as of September 30, 2025. This comes even as the US Dollar Index has declined by around 10% against other major currencies. Consequently, the INR’s fall against key global currencies has been even more pronounced.

The INR has weakened by approximately 17% against the Euro and about 10% against the Japanese Yen. Even in relation to other Asian peers, the INR has been a notable underperformer in 2025.

Chart I: INR underperformed most currencies in 2025 so far

What led to this divergent fall in the rupee?

We can broadly categorise the key drivers of the INR into macroeconomic fundamentals, relative valuation against trade partners and capital flows. Additionally, the RBI’s interventions in the currency market also play a significant role in influencing the INR.

Let’s explore these in greater detail:

1) Macroeconomic fundamentals

-

Growth: India’s GDP grew by 7.8% YoY in the April-June quarter of FY 2025-26. While there are risks associated with trade-related uncertainties, overall GDP growth is trending close to its long-term average of 6.5%, outpacing most large economies.

-

Inflation: The CPI inflation remains well below the RBI’s target of 4%. Looking beyond the adverse base effect, underlying inflation is expected to remain benign even into next year.

-

Fiscal Position: Although there has been a slight slowdown in tax revenue growth this year, the government remains on track to achieve its fiscal deficit target of 4.4% for FY26. Overall, the government’s fiscal policy continues to be prudent.

-

External Balances: The current account deficit is around 1% of GDP, manageable by Emerging Market (EM) standards. While US trade tariffs could exert some pressure on the current account situation going forward, declining crude oil prices, resilient services exports and robust remittances are likely to mitigate much of the impact.

-

External Debt: India's external debt stands at 18.9% of GDP (as of June 30, 2025), which is lower than most EM peers.

-

Foreign Exchange Reserves: As of September 26, 2025, India’s foreign exchange reserves stood at over USD 700 billion. This is sufficient to cover more than 11 months of merchandise imports and about 93% of India’s total external debt.

To summarise, India’s macroeconomic fundamentals remain robust. It appears improbable that this can lead to relative depreciation of the INR.

2) Relative value against trading partners

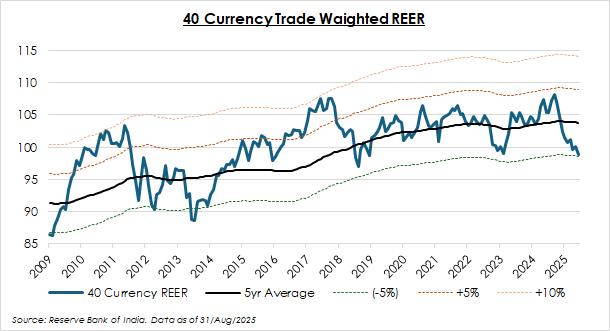

A commonly used metric to gauge the relative value of a currency against its trading partners is the Real Effective Exchange Rate (REER). The REER is a trade-weighted index that measures a country's currency value relative to a basket of other currencies (its trading partners), adjusted for inflation.

The RBI’s trade-weighted 40-currency REER shows the INR broadly in line with its long-term average. However, compared with peers, the INR had been viewed as relatively resilient and even “expensive” in previous years, as it depreciated less than most other emerging-market currencies. This earlier relative strength created scope for some “catch-up depreciation” in 2025.

That said, on a relative valuation basis, the INR now appears to have corrected a bit too much. As of August 31, 2025, the 40-currency REER of the rupee stood below par at 98.8. Based on the historical average of REER, the INR currently appears undervalued by at least 4%.

Chart II: The INR seems undervalued against trading partners

3) Capital Flows

India attracts substantial foreign investment due to its strong growth prospects. In a typical year, the surplus in the capital account hovers around 2% to 2.5% of GDP. However, this has seen a significant drop in 2025. As per data up to June 30, 2025, net capital inflow for this year stands at just USD 2.25 billion, which is just 0.1% of our GDP. The primary reason for this decline is a notable fall in foreign equity capital inflows, including both Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI).

Historically, India used to receive around USD 30-35 billion in FDI annually before the COVID-19 pandemic. FDI inflows then surged to nearly USD 40-45 billion per year during FY20-22. Since then, however, FDI inflows have declined sharply, to just USD 1 billion in FY25. Although it rose to USD 6 billion in the April-June quarter of FY26, it remains significantly below its historical average.

Foreign portfolio investors have also been net sellers in the Indian equity markets, withdrawing approximately USD 17.4 billion from the beginning of 2025 up until September 30, 2025.

Capital flows, by their volatile nature, tend to overwhelm fundamentals in the short term. This has been the key drag on the INR in 2025.

4) Geopolitical Churn

In addition to the aforementioned factors, the INR has also been significantly influenced by the ongoing geopolitical churn. In recent months, India's relationships with major powers such as the US, China and Russia – and the way these relationships are perceived – have undergone considerable change.

Amid US President Trump’s reset of global trade relations, India was initially expected to receive favourable treatment from the US. Instead, India now faces one of the highest tariff rates at 50%, comprising a 25% reciprocal tariff and an additional 25% penalty on its crude oil imports from Russia. Furthermore, changes in H-1B visa regulations and the proposed HIRE Act could further impact India’s trade and labour relations with the US.

Meanwhile, the Indian government has been attempting to restore ties with China, though this remains a challenging endeavour given the history of military tensions between the two nations.

Overall, strained relations with the US have dampened market confidence and likely contributed to the INR’s weakness in 2025.

5) RBI Interventions

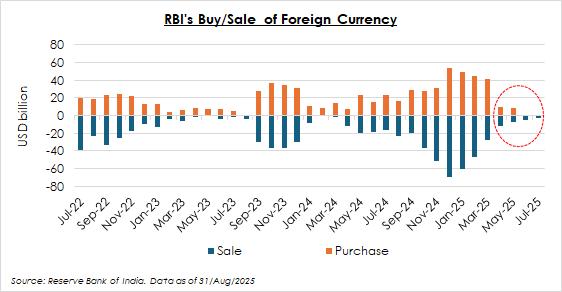

Over the last few years, the RBI has been actively intervening in the currency market to prevent sharp movements in the rupee. Such interventions typically intensify during periods of heightened volatility in global currency markets.

However, contrary to its past behaviour, the RBI has significantly curtailed its interventions in the foreign exchange market in recent months, allowing the INR to depreciate more freely. Between April and July 2025, the RBI’s average monthly purchase /sale of foreign currency was around USD 12 billion, compared with a monthly average of USD 63 billion during the previous fiscal year.

The RBI continues to hold a substantial foreign exchange reserve of about USD 700 billion. This provides it with ample capacity to intervene if needed to defend the INR against potential exogenous shocks.

Additionally, the RBI currently holds an outstanding short position of USD 53 billion in currency forwards, of which USD 33 billion is due for maturity within the next 12 months. This implies that the RBI is expected to provide around USD 33 billion of foreign currency to the banking system over the coming year.

Chart III: RBI curtailed interventions in the currency market, allowing the INR to depreciate

The Bottom Line

The INR’s relative depreciation in 2025 can best be understood as the interplay of the following forces:

-

Economic fundamentals remain strong, although external risks such as trade tensions and visa-related changes have tilted the outlook slightly negative.

-

Relative valuation points to some scope for catch-up depreciation, but the recent decline has been excessive, leaving the INR undervalued against peers.

-

Capital inflows have experienced a sharp downturn, emerging as the primary contributor to the INR's relative depreciation.

-

Investor sentiment has been dampened by geopolitical uncertainties and trade tensions.

-

Reduced RBI intervention has allowed the INR to adjust freely to market dynamics.

Taken together, these factors suggest that the INR’s weakness in 2025 is largely cyclical – driven by capital flows and sentiments – rather than structural. India’s robust macroeconomic fundamentals should continue to support the INR and create a buffer against any sharp depreciation going forward.

Overall, the INR's movements are likely to remain more gradual in the coming months, provided trade frictions with the US ease.

Vetri Subramaniam is the MD & CEO Designate at UTI Asset Management Company Limited. He holds a B.Com degree from University of Madras and a Post Graduate Diploma in Management from Indian Institute of Management, Bangalore. He joined UTI AMC as Head of Equity in January 2017, was elevated to Chief Investment Officer in August 2021 and has taken on the role of MD & CEO Designate. Prior to UTI, he held leadership and investment roles at Invesco Asset Management Private Limited, Motilal Oswal Securities Limited, Kotak Mahindra Asset Management Company Limited, SSKI Investor Service Private Limited and Kotak Mahindra Finance Limited.