- 3 views

For years, Indian car buyers have prioritised mileage, with hatchbacks and sedans symbolising urban aspirations. Yet, even then, Multi-Purpose Vehicles (MPVs) held their ground – valued for their space, power and durability.

Today, the Sports Utility Vehicle (SUV) dominates India’s roads. Buyers are now drawn to models that blend versatility, comfort and a touch of luxury, creating a perfect fit for evolving lifestyles.

Interestingly, this shift mirrors the evolution in investors’ thinking as well. Their focus has shifted from chasing a single driver of returns to building well-rounded portfolios that can perform across market cycles. Like SUVs, blend investment strategies are adaptable. Built on strong fundamentals, they are agile enough to navigate changing market terrains while balancing long-term compounding with the flexibility to seize emerging opportunities.

Blending stability and opportunity

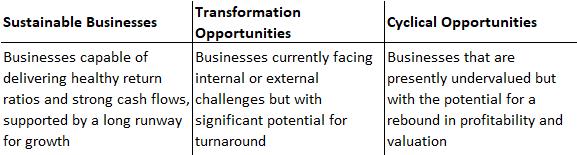

Dynamic, diversified and high-conviction portfolios are the true vehicles of wealth creation. They deliver performance, protection and purpose. With a similar approach, I follow a blend investment strategy that aims to balance stability with opportunity, focussing on three distinct allocation buckets:

-

Sustainable Businesses

-

Transformation Opportunities

-

Cyclical Opportunities

Sustainable Businesses form the core of the portfolio, accounting for 50-70% and providing stability. Transformation and Cyclical Opportunities make up the remaining portion of the portfolio, driving alpha generation.

Let’s understand each of these buckets in detail with a few examples.

-

Sustainable Businesses

These businesses have a proven track record of delivering strong returns on capital employed (ROCE) and healthy operating cash flows. Their growth is largely self-funded through internal accruals, with minimal dependence on external debt or fresh equity.

In our research framework, this group aligns closely with the R1 C1 category: companies known for their superior quality and consistent performance. While such firms often trade at premium valuation multiples, thereby raising the overall portfolio valuation, their robust ROCE profiles and long growth runways can still drive attractive returns over time.

-

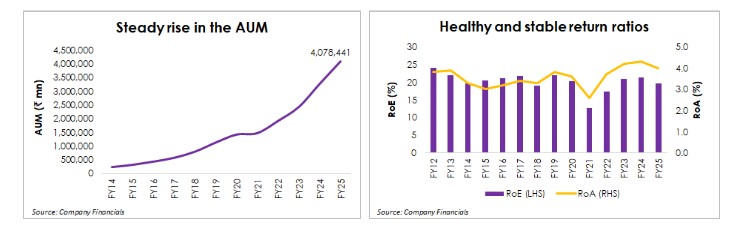

Bajaj Finance: The company has exhibited a decade-long upward trajectory in assets under management (AUM) and a consistent track record of generating stable and healthy return ratios across different market environments.

-

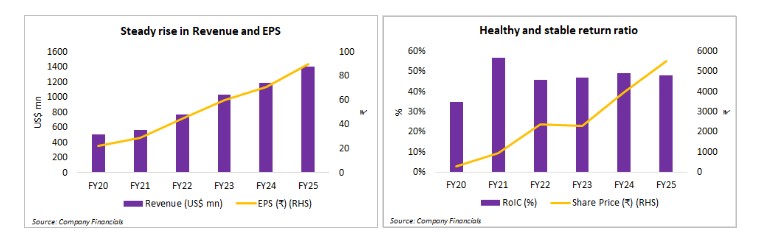

Persistent Systems: A mid-tier IT services provider, the company has delivered industry-leading revenue and EPS CAGR of 23% and 32%, respectively, over the past five years. It has consistently generated a healthy RoIC of an average of 47% during this period, supporting strong share price appreciation.

These businesses hold significant potential thanks to their capabilities, brand strength, or cost advantages. However, they are currently underperforming due to internal or external factors such as management changes, regulatory shifts or rising competition.

As a result, they often trade at valuations below their peers or their own historical averages. Identifying such opportunities early – when these factors begin to improve and financial performance shows signs of recovery – can create attractive prospects for alpha generation within the portfolio.

-

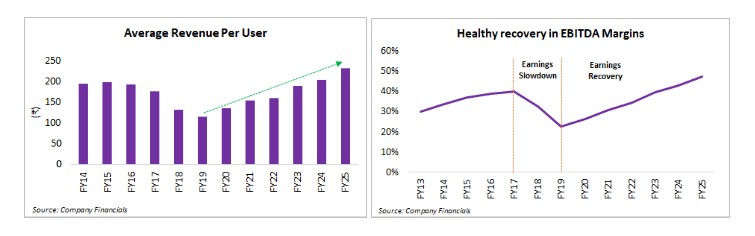

Bharti Airtel: The company represents a classic transformation story: profitability declined when competition intensified after 2016. However, as the industry consolidated and average revenue per user (ARPU) began rising, its earnings recovered strongly over the past four to five years.

-

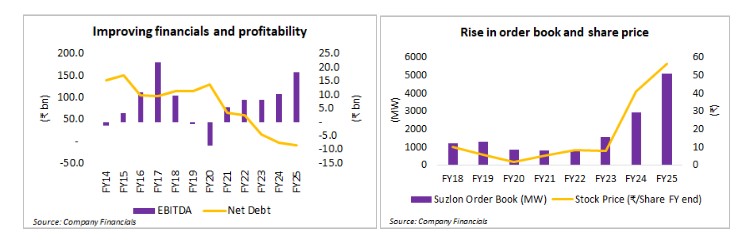

Suzlon Energy: The company faced challenges with high leverage, but its financial position improved markedly after FY21, as reflected in reduced debt levels and robust EBITDA growth. Coupled with healthy order book expansion, these factors have contributed to strong share price performance.

These opportunities often arise in cyclical sectors such as metals, automobiles, industrials, and oil & gas. Companies in these industries may currently be experiencing a downturn, reflected in lower profitability and/or valuations compared to their historical averages. However, if profitability is expected to rebound as the cycle turns and valuation multiples improve alongside it, these situations can offer attractive alpha-generation potential for the fund.

-

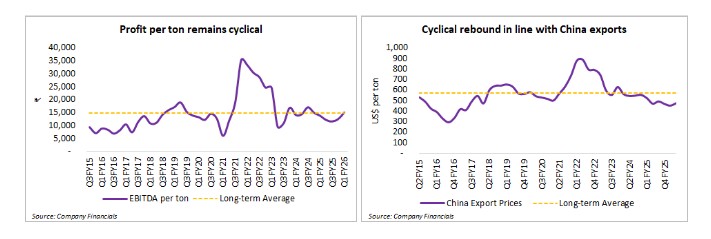

Tata Steel: The company experienced a sharp spike in profitability post-COVID, but this growth was reversed following the Russia-Ukraine conflict. EBITDA per ton fell below its historical average, while Chinese steel prices dropped to their lowest levels in eight years. Under these conditions, a cyclical rebound in profitability was likely, a trend that has materialised over the past six months, supported by the government’s imposition of import duties on steel.

-

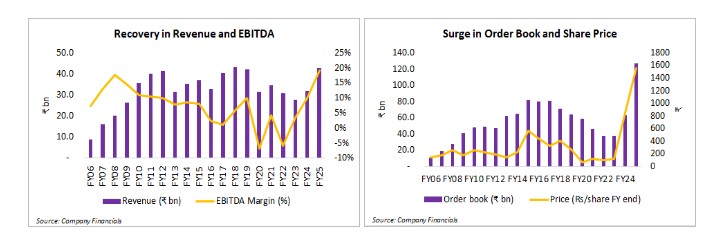

GE Vernova T&D India: With an improving industry cycle, the company has seen a sharp turnaround in EBITDA margins over the past three years, reversing a 15-year downward trend. Order inflows have also improved significantly in recent years, driven by the cyclical upswing, which has contributed to strong share price performance.

Built for all terrains

Just as an SUV performs reliably on every kind of road, a blend strategy – investing across the three buckets – enables the portfolio to perform well through all market cycles, delivering steady, long-term returns while keeping risks in check. Moreover, this blend approach ensures that businesses with an average RoCE lower than their cost of capital over the cycle, as well as those with inconsistent cash flow generation resulting in poor returns, are kept at bay.

The objective is to maintain a balance between risk and return through a portfolio constructed using a bottom-up stock-picking approach and a blend strategy that combines investments in both growth and value opportunities. The approach is dynamic and adaptable, aiming to deliver relatively consistent performance through cycles, while keeping risks well-managed.

The charts shown above are for illustrative purposes only and should not be construed as advise. The above is to illustrate the concept of identifying stocks in the market and not an endorsement by the Mutual Fund and AMC of their soundness or a recommendation to buy or sell these stocks at any point of time. There is also a possibility of the expected event not happening or some other unforeseen event that may affect performance of the company. The performance of stocks would ultimately depend on various factors such as prevailing market conditions, global political scenario, exchange rate etc. Investors are requested to note that there are various factors (both local and international) that can have impact on the future performance and expectations of any company. There is no assurance or guarantee of any company being able to sustain its performance in future and above information should not be construed as research report or a recommendation to buy or sell any security.

The views expressed are the author’s own views and not necessarily those of UTI Asset Management Company Limited. The views are not investment advice and investors should obtain their own independent advice before taking a decision to invest in any asset class or instrument.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Vishal Chopda is Senior Vice President & Fund Manager – Equity. Vishal joined UTI AMC in January 2011 as Research Analyst and has covered FMCG, Retail, Consumer Durables, Telecom, Cement, and Building Materials in his research role. He took up fund management responsibilities in February 2018. Prior to joining UTI AMC, he worked with CARE Ratings and TCS. He holds PGDM from Management Development Institute (MDI) Gurgaon and CFA charter from CFA Institute, USA. He completed his Bachelor of Engineering from Mumbai University.