- 2 views

One of the expectations from fixed income asset managers this time of the year is their annual forecasts on inflation, repo rate or government bond benchmarks. Forecasting typically involves answering the following question: “Given the data we see today, what will be the value of a variable at a period”. It is often said that forecasting exists to make astrology look good. If someone had given a prediction in the beginning of the year that 10-year US treasuries (UST) would be trading at 1.55% (as on 29 Dec 2021) with a 4.9% core inflation (Nov’21), we probably would have a hard time not only believing the US 10-year yield but such a high core inflation.

The world is not the same as before as we enter the “new normal”. There are already signs of fundamental changes in workforce behaviour, realignment of supply chains, upsurge against global warming & Government approach.

It’s become even more important to be nimble & take a “balance of risks” approach to utilize future opportunities. The two opposing narratives for bond market as things stand today are:

Narrative I: Fade out of inflationary pressures, sanguine RBI & robust flows in Fixed income due to bond inclusion

1) Transient global inflation

Global economic activity is improving modestly beyond the base effects & central banks will “need” to ignore supply side inflation & pent-up demand which should dim out in next 12-15 months. If the assumption is correct, then the developed world will look very much like the “secular stagnated” we have all been witnessing since the Great Financial Crisis (GFC).

2) Sanguine RBI

RBI now following a glide path approach to 4% CPI rather than trying to achieve the target continuously. Hence, it will be calibrated in its normalisation as it tries to address the substantial output gap which it believes will take years to narrow.

3) Bond demand

Bond index inclusion could somewhat address the demand/supply balance in absence of RBI bond purchases on account of FPI inflows

Narrative II: Inflation is entrenched & will require global central banks action to anchor inflation expectations

An initial inflation shock driven by the transitory impacts of the pandemic has now progressively broadened to affect the entire value chain. Supply-chain challenges have intensified additionally due to green initiatives and geo-political disruptions & are proving to be more persistent. Even if growth moderates as the tailwinds coming from the pandemic-related fiscal support and pent-up demand diminish, central banks might have to act emphatically to anchor inflationary expectations.

What will transpire & how central banks deal with it will be a subject of textbooks, but a portfolio construction today does not have the preserve of being at an impasse.

We try to explore the three main factors which are driving our thinking towards future outcomes & how it is influencing our portfolio construction.

1) More than expected tightening by global central banks in case of entrenched inflation

2) Risks of high food inflation for India

3) Bond Supply dynamics for India

These three factors are elaborated below:

A. Return to traditional tenets by central banks:

“Und wenn du lange in einen Abgrund blickst, blickt der Abgrund auch in dich hinein.”

If you gaze long into the abyss, the abyss gazes into you – Nietzsche

As can be seen from the table below, there is a meaningful disconnect between inflation targets of global central banks & actual inflation readings consequently leading to significantly negative real rates in the developed world.

![]()

Possibly, the reluctance of central banks to take the spike in inflation seriously was probably motivated by past, notably in 2019 when the unemployment rate in the US fell to 3.5% – near 50-year lows – and yet inflation did not rise above 2%. In fact, The US Federal Reserve (Fed) finalised its flexible average inflation targeting last year in August 2020 where it expressed that it needed a period of higher inflation to raise inflation expectations consistent with achieving its goal of averaging 2% inflation in the future. It was broadly believed that it was possible to run the economy hotter for longer without fuelling inflation with the Philips curve being flatter.

However, that belief has changed. Most of the FOMC (Federal Open Market Committee) members through their various speeches have indicated that US is about to reach maximum employment. The Bank of England (BOE) despite concerns of Omicron surprised the markets with a rate hike to anchor inflation expectations. FOMC retired the word transitory in their December policy, accelerating the tapering from $15 billion to $30 billion & median Fed projections now show three rate hikes each in 2022 & 2023 & another two in 2024. Given the excess reserves of approximately $1.6 trillion in the Reverse Repo facility, it is also possible Fed lets its balance sheet run off once its QE (Quantitative Easing) program gets to zero.

However, bond markets have barely budged despite 4%+ forecasts for 2022 global GDP growth (Source: OECD) and a tightening labor market. The below chart present the 10 year UST & 10 year breakeven which has in fact rallied 20bps since November.

![]()

The reason for bond market indifference could possibly stem from participants believing that factors such as declining impact of fiscal stimulus, deleveraging cycle in China, supply chain disruptions and tightening of global financial conditions may dampen growth sentiment & might provide an opportunity to central banks to reduce the pace of tightening.

B. Risks to market implied terminal rates from higher food prices

India’s headline inflation has been well behaved so far with India being one of the few countries to witness higher inflation during the pandemic compared to most of the major economies experiencing inflation post re-opening. Bond yields have been well behaved & curve has retained its steepness as market participants believe RBI normalisation will be gradual. The table below presents the call fixing levels assumed on various days & corresponding notional/actual swap levels.

![]()

As can be seen from the table above, the swap market is now reflecting a 5.5% terminal rate broadly by April 2023. This is very much in the realm of possibility given the current MPC (Monetary Policy Committee) is comfortable with negative real rates till growth becomes entrenched. It is reasonable to expect that neutral rate of interest even once growth becomes self-sustaining has come down for India from the 150-200bps & the 125bps RBI considered during 2013 & 2016, respectively given long term neutral rates have also come down globally compared to previous cycles.

However, the above dynamics assume that the current rise in inflation is a hump & will progressively ease on account of unwinding of supply chain bottlenecks & “bullwhip effect” i.e. high inventory rebuilding in sectors currently witnessing shortage, leading to glut & hence lower prices in future. As Deputy Governor Dr. Patra explained in the post December policy press conference, the RBI is looking at inflation coming down in the range of 4-4.3% by the end of FY23.

However, inflation expectations especially for India would depend a lot on food price behavior going forward. The current fall in headline CPI is primarily due to well behaved food inflation which is significantly lower than its long period average.

![]()

![]()

Some factors are worth noting for understanding future drivers for food prices. As can be seen from the chart above fertilizer prices & global food prices are at their multi year highs due to following factors:

1) Global demand for staples for general consumption and animal feed has increased as countries have stockpiled food reserves to address perceived food security.

2) The recent La Niña episode has led to dry weather in key food exporting countries, including Argentina, Brazil, Russia, Ukraine, and the United States. This has caused harvest outlooks to fall below expectations.

Strong demand for biofuels & export restrictions from food producers.

C. Constrained capacity for Government borrowing

The government has carried out a tough balancing act between supporting economic revival while maintaining practicable degree of fiscal consolidation despite calls for aggressive stimulus measures especially during the 1st wave.

After attaining a GFD (Gross Fiscal Deficit) of 9.5% of GDP in 2020-21, the Union government has budgeted for a GFD of 6.8% of GDP in 2021-22 with the medium-term target of below 4.5% by 2025- 26. The RBI on its part also provided the necessary anchor to bond yields by embracing yield curve as a public good thereby legitimising its aggressive bond buyback programs under its GSAP & simultaneous buy/sell operations (Operation twist).

While quantum & pace of normalisation by central banks will have a bearing on bond yields, potential demand/supply gap could be a significant driver for bond yields even in a slow normalisation environment.

As can be seen from the table below, there is a possibility of a substantial demand/supply gap for sovereign bonds despite assuming a $30 billion inflow from FPI post index inclusion. The table below lists the net sovereign borrowing (GSEC+SDL) & probable demand from various market participants. Given the substantial maturities in the upcoming years, borrowing could remain under pressure even in future years without meaningful central bank support.

![]()

Additionally, one aspect investors can keep in mind is curve might not flatten materially in this normalisation cycle as the Government has been trying to elongate its maturity profile by issuing substantial part of its borrowing on the longer duration.

As can be seen by the table below, rate cycles have become shallower, as global growth cycles have matured. Barring any meaningful change in quantum & pace of central bank tightening, curve could remain steep for a longer period unless Government changes its borrowing mix.

![]()

One of the possible ways Centre is looking to plug the borrowing gap is to raise resources through asset monetisation. An aggregate monetisation potential of INR6.0 lakh crore, over a four-year period, from 2021-22 to 2024-25, is estimated under the National Monetisation Pipeline, with an indicative value of INR0.88 lakh crore envisaged for the current financial year. However, the actual realization will depend on the quality of execution.

Outlook - Focus on controllables

As policy normalization commences, the year will probably be an inflection point for the global & Indian economy where we would probably get to know whether we are in a high growth & high inflation, a stagflationary or even a stagnated (low growth-low inflation) world getting into second half of the year. While it may take a while for market participants to envision shifting economic tides from structural point of view, there are some sub structures which we can act upon from an asset allocation perspective.

- Long path of fiscal consolidation: We can reasonably expect that government finances in terms of fiscal consolidation could take 3-4 years to repair & reach to pre-pandemic levels hence keeping bond supply high. In case GST collections cannot reach historical buoyancy of pre-GST indirect tax collections, the fiscal situation could only get worse.

- Increasing average maturity of Public debt: We can reasonably infer from various official communiques for the preference to increase average maturity of Government debt. This coupled with significant upcoming maturities increases possibilities that the borrowing program may be concentrated towards the longer duration (10 years & beyond).

- Near term factors: As we enter the final quarter of FY22, we can reasonably expect greater unpredictability on the money market curve in case RBI decides to implement its fine-tuning operations as stated in December 2021 policy. In addition, usual final quarter balance sheet expansion related borrowing by financial institutions, credit related supply from corporates coupled with expectations of stance change/normalization from RBI in April 2022 policy could keep things precarious initially.

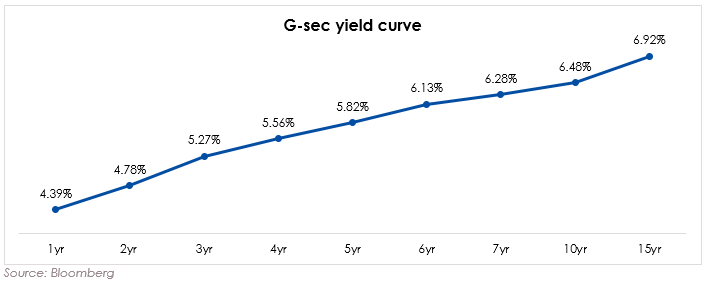

- Steepness of the curve: As can be seen from the chart below

The steepness on the curve especially on the 5-7 year segment is pricing in a fair level of normalization from the RBI in next 2 years. This provides reasonable opportunities for investors across product categories who can allocate as per their appetite for intermittent volatility.

The past year was of relentless and often daunting challenges. Many of our lives remained on pause. Many of us lost loved ones. Even the idea of looking back on this year seems intimidating.

The last year was extraordinary for all of us personally. If we had to summarize 2021 into three words, we would probably like to express it by saying “Keep moving forward”. We had no choice but to move on where we appreciate our small victories, fortitude & sacrifices we made in the moment. As L. Frank Baum wrote in “The Marvelous Land of Oz” “Everything has to come to an end, sometime.” We sincerely hope that the trying times we all have gone through have indeed come to an end & we can all look forward to a much happier & meaningful new year.

Wishing everyone a very Happy New Year!!!!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.